News

Anzac Day 2024

Anzac Day 2024 memorials dates and places.

Primary producer freight subsidy assistance

Primary producers and non-profit organisations (NPO’s) who have recently been affected by ex-Tropical Cyclone Megan and associated flooding can apply to access grant funding to support recovery efforts.

Celebrating the achievements of the Territory’s apprentices and trainees

The Territory Government is getting Territorians work ready as we continue to grow our economy to $40 billion by 2030.

Beloved Territory events recognised nationally

Two of the Territory’s most loved events have been recognised for innovation and excellence at the Place Leaders Asia Pacific Awards.

Have your say on the NT Drone Industry Strategy

Territorians are invited to have their say on a new draft strategy designed to advance the growth of the local drone industry.

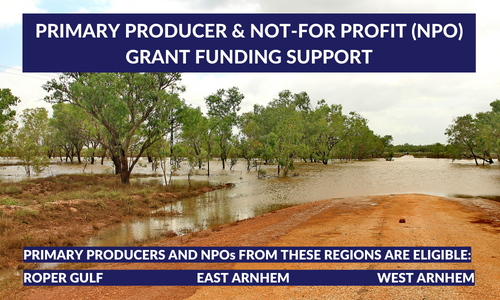

Disaster Recovery Grant Programs Now Available

Primary producers and non-profit organisations (NPOs) who were affected by the recent northern region flooding can now apply to access grant funding to support recovery efforts.

Welcome to Territory Services

Territory Services is a new online services portal where people can go to perform a transaction with the Northern Territory (NT) Government.

Applications are now open for the 2024 Animal Welfare Fund grant program

Northern Territory businesses are invited to attend information sessions on how they can use migration programs to fill vacancies.

Telstra 3G network - stay connected after June 2024

Are you still using the Telstra 3G network? The 3G network will no longer available from 30 June 2024.

Apply for funding to support your community project

Round 2 grants for the Community Benefit Fund are now open to support Territory not-for-profit organisations to deliver services, programs and events to Territorians.

2023 New Year Eve events across the Territory

A series of free, family friendly New Year’s Eve events are being planned across the Territory.

Basement Jacks – Where’s your stock at?

Australia’s fishing and aquaculture resources are among the best managed in the world.

Set sail at the iconic Darwin Lions Beer Can Regatta

Expertly designed boats made out of cans – and the teams trying to sail them - will provide hours of entertainment at the iconic Darwin Lions Beer Can Regatta on Sunday, 16 July.

Defence Accommodation Precinct Darwin

The Commonwealth and the Northern Territory have today signed an agreement to establish the Defence Accommodation Precinct Darwin at Howard Springs.

Laramba Water Treatment Plant officially opened

The Laramba Water Treatment Plant was officially opened on the 26 April 2023.

Lest we forget – Light Up The ANZAC Spirit

In support of this year’s ANZAC commemorations, our history will come to life in a new way, with moving and powerful symbols of ANZAC illuminated by projections in Katherine and Darwin.

Anzac Day 2023

Find out about Anzac Day 2023 memorials dates and places.

Increased safety measures for Alice Springs

The Northern Territory has outlined a number of measures to address anti-social behaviour and crime in Alice Springs.